The market for financial services is fragmented. A customer can easily purchase different financial products from different financial institutions. There is little added value to be gained by customers who bundle their banking transactions at a single institution. A bank faces fierce competition from other institutions when finalising each additional product – in a situation where direct contact with customers is increasingly dwindling and it is difficult to establish or maintain customer relationships.

Online applications that are perfectly easy to use with a full focus on the fast processing of transactions as well as comprehensive and clear reporting are essential so as not to actively put off existing customers. In addition, a bank needs useful service features that inspire customers and keep them on the platform.

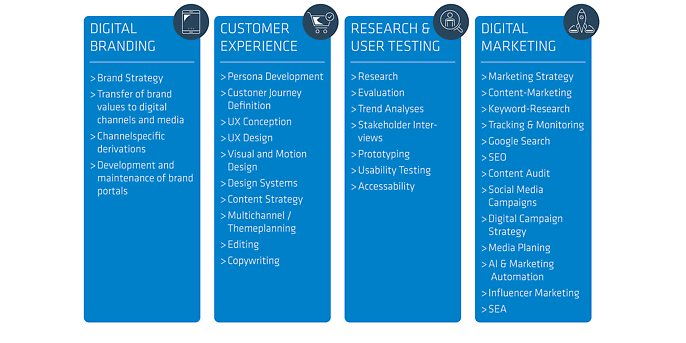

When it comes to communication, it is essential to use the right storytelling to continuously reach existing and potential customers. All channels need to be properly orchestrated. Here, we focus on the following points:

- Create experiences to inspire customers and make a positive lasting impression on them. Topics relating to the individual experiences of the interested parties are chosen.

- Reach target groups and attract attention with relevant content. During digital application processes, case-closing assistance is provided without media disruptions and with maximum conversion.

- Omnichannel presence in the B2B and B2C sector to provide suitable content and offers – on the website, customer portal and in social networks.

- Always ready to provide information on current marketing activities and successes