Press Releases

Dortmund/Leipzig |

Study: Life insurance business model from a European perspective

The “Business Model Life Insurance 2025 - 2030 – A European Perspective” study published by adesso insurance solutions and Versicherungsforen Leipzig forecasts the further development of the business model and offers guidance for the strategic orientation of life insurers.

The persistent low interest rate environment, European regulations, the increasing relevance of neo-brokers and the topic of sustainability: the life insurance business is undergoing major changes which are being driven by political, economic, environmental and technological factors. This, on the one hand, presents insurers with major challenges, and on the other hand, it opens up completely new opportunities for continuing to operate profitably in the future.

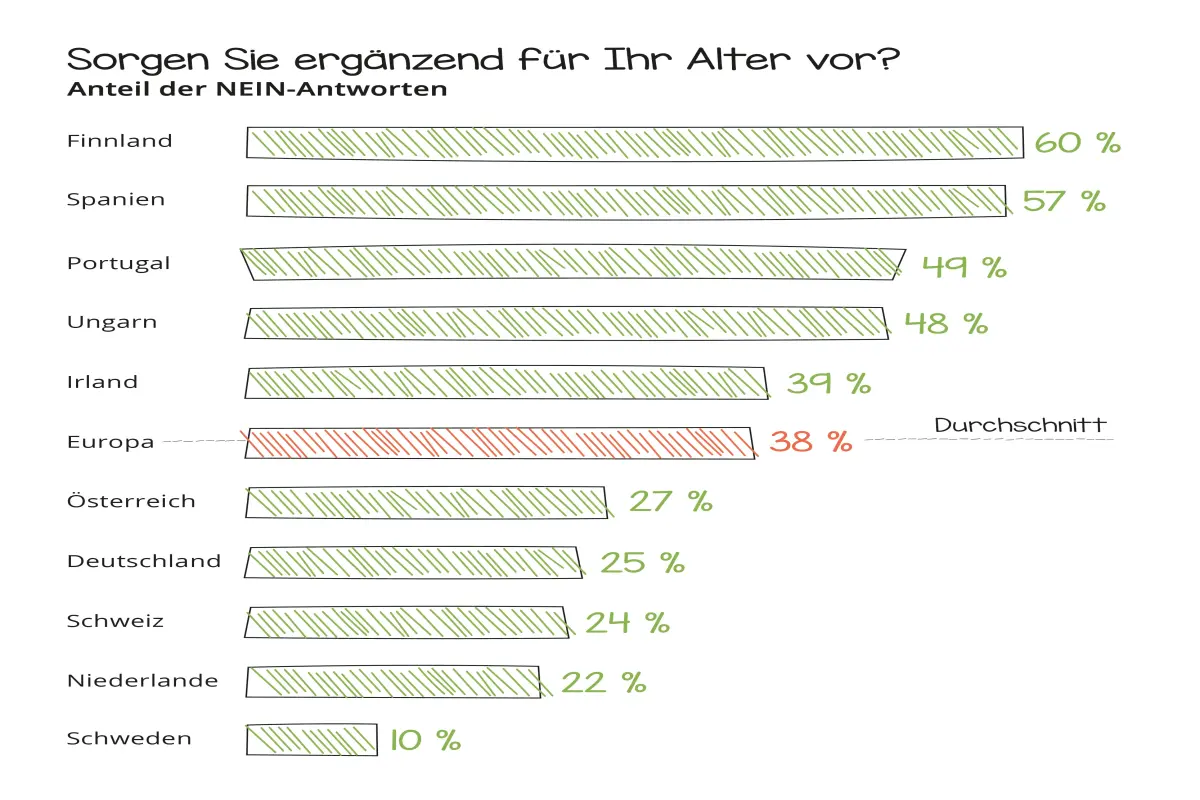

It can be assumed that the market will be increasingly dominated by biometric products and unit-linked policies without guarantees in the future. Occupational pensions will also continue to grow in importance and also offer international potential, since the structure of pension systems varies from one European country to another. The proportion of people who make provision for their retirement ranges from 40 percent in Finland to 90 percent in Sweden (see Graphic).

The study also shows that the level of digitization is still low compared to other lines of business and industries. In the future, insurance companies will have to develop their competitive advantage in the market through digitization, efficient processes and focus, because the key differentiator will be in the area of costs. The trend toward niche products for specific target groups, e.g., term life insurance for certain sports or retirement provision for special occupational groups, will continue.

Six promising business models

Based on this analysis, six promising business models emerge, with different characteristics in each European country:

1. Insurers who want to adopt the cost leader business model are focusing on simple products with low acquisition costs and on digital services. The Scandinavian countries are playing a pioneering role here.

2. Those who want to become ecosystem providers must build up a comprehensive range of services to reach customers and suppliers. In this area, the trend in Switzerland is for providers of occupational pension scheme services to join forces.

3. In markets where adequate ecosystems are forming, insurance companies can act as ecosystem suppliers. In Eastern Europe, insurers are positioning themselves as partners in the “finance” ecosystem, and in the Netherlands, Premium Pension Institutions (PPI) or insurers are supplying specific pension products to various employers.

4. The asset manager business model focuses on investment, which is not only interesting for Swiss insurers. To be successful in the market, there is a need for insurance products which are purely unit-linked or that combine guarantees with smart investment.

5. The health expert business model focuses on biometric products or on health-conscious target groups. This model is found in Spain and the United Kingdom, where biometric risks such as death, disability and critical illness are predominantly covered. New customers are often acquired in the context of real estate financing.

6. Target group insurers concentrate on specific niches, which often results in overlaps between different business models. For example, the cost leader business model is also useful in serving the target group of cost-conscious

When commenting on the results of the study, Harald Narloch, Managing Director at adesso insurance solutions, said, “Insurance companies can develop a promising strategy by focusing on their own competencies, niches and digital innovations. The increasing alignment in European regulation also means that business models can be adapted and deployed across national borders.”

Harald Narloch, Managing Director adesso insurance solutions GmbH

“Over the past decades, the life insurance industry has proven to be resilient and has managed to reinvent itself again and again,” said Justus Lücke, Managing Director of Versicherungsforen Leipzig. “Our study gives every insurance company the opportunity to identify a sustainable business model that best fits its current situation.”

Justus Lücke, Managing Director of Versicherungsforen Leipzig GmbH

About the Study

The “Business Model Life Insurance 2025 - 2030” study was initiated by adesso insurance solutions and prepared together with Versicherungsforen Leipzig. The study consisted of four phases: The first phase included research and evaluation of the content of existing studies and publications as well as the identification of possible drivers and their effects. This was followed by a second phase of in-depth expert interviews with 14 industry representatives from European insurance companies. Interviews were then conducted with 62 actuaries to gather their opinions. Finally, the results were combined to identify future scenarios and opportunities. The study (in German) can be downloaded here: www.perspektiven-lv.de

Press service

Materials for media reports

With our press service, we provide you with various materials that complement our corporate news or serve as background information.

Do you have any questions?

Do you have any questions about our press service or a specific request? Please contact us.

Communications Manager Nils Roos +491704406148 nils.roos@adesso.de