3. June 2024 By Maja Anita Sach

Artificial intelligence and insurance brokers: a new era of collaboration

In a world where technology is advancing at an unstoppable pace, professions of different insurance intermediary types need to adapt the way they work in order to stay relevant. One of the most exciting developments in this area is the integration of artificial intelligence (AI). Traditionally, the work of intermediaries has relied heavily on personal relationships and expertise. However, with the advent of AI, their tasks and approaches are changing. But how do insurance brokers feel about this new technology?

Challenges and opportunities in the insurance industry

One of the biggest challenges for insurers is managing the ever-growing volumes of data. This is where AI comes into play. Through machine learning and data analysis, algorithms can quickly process large amounts of data and recognise patterns that are relevant for individual insurance advice.

The results of a survey conducted among participants from the insurance industry as part of DKM 2023 show that AI offers a wide range of potential applications. The survey was conducted by the author herself. Sixty-one people took part in the survey, including insurance brokers from the internal and external sales force. These tools can be used to save time and support routine tasks, particularly in the areas of risk assessment, claims notification and processing, customer service, internal communication and knowledge management.

Selection: What are the potential applications of AI in the insurance industry?

Insurance brokers and AI

But how do insurance brokers view this development? Some fear that AI will make their role superfluous. After all, algorithms could theoretically do the same work faster and possibly more accurately. But the reality is more complex.

In fact, most insurance brokers see AI as an opportunity to improve their work rather than as a replacement. A survey of insurance brokers (16th AfW Broker Barometer 2023 (1108 insurance brokers)) conducted in 2023 found that over 70 per cent of respondents see AI as an opportunity to increase their efficiency and offer their customers a better service. Younger brokers generally show a greater interest in digital and AI-based solutions for advisory, support and claims settlement processes than older brokers. They often do not yet have the professional IT systems that are common in larger brokerage firms and face complex digital challenges due to their diverse direct and pool connections.

Areas of application of AI tools for insurance brokers

Customer advice: Targeted surveys ("Digitalisation in broker sales: status quo and future prospects of insurance brokers" by ITW and HEUTE und MORGEN, 2023 (300 insurance brokers)) of brokers revealed a clear reluctance to use AI tools in customer advice, such as automatic customer profile analyses and sales pitch suggestions. Only 23 per cent expressed interest, while the vast majority see this as an intrusion into their expertise in customer advice, as the authors of the study found.

In contrast, salespeople see great potential for AI tools, particularly in the area of administrative tasks, and are planning to integrate them into their future workflows.

Chatbots and virtual assistants have become an integral part of customer service in the insurance industry. They provide immediate answers to customer enquiries and help to clarify insurance terms and conditions, for example.

58 per cent of brokers are interested in using voice recognition software that records customers' claims reports over the phone and automatically alerts brokers to missing information or documents. AI-supported image recognition technology is becoming increasingly important in the area of claims assessment and settlement.

Insurance brokers also use various AI tools for text creation in order to communicate more efficiently and create high-quality content. One popular tool is "Grammarly", which uses AI to recognise grammatical and spelling errors and make suggestions to improve writing style.

AI tools such as those from UiPath are used to automate administrative tasks. Time-consuming administrative tasks such as data processing, for example viewing and indexing emails or checking documents, can be automated. This allows employees to concentrate on customer-orientated tasks and increase their efficiency at the same time.

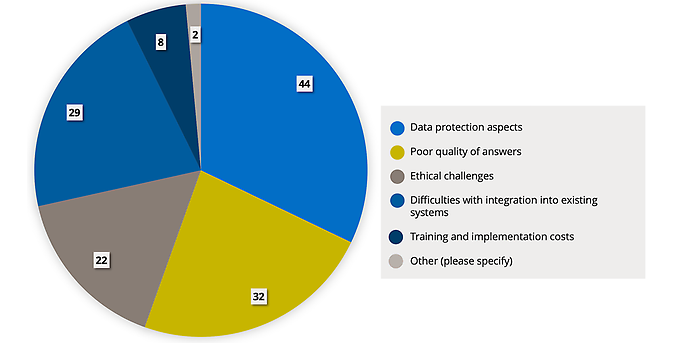

Concerns and hurdles

Of course, there are also concerns about the use of AI in the insurance sector. Data protection and data security are important concerns, especially when it comes to the processing of sensitive personal data. Insurance brokers must ensure that they comply with data protection regulations and clearly explain to their customers how their data will be used.

There is also a risk of AI systems being biased or drawing the wrong conclusions. When algorithms are trained on incomplete or erroneous data, they can produce biased results. It is therefore important that insurance brokers critically scrutinise the results of AI systems and use human intuition and expertise to make informed decisions.

What are the biggest hurdles when using large language models?

Summary

Technological progress is also changing the traditional professions of insurance brokers. One important development is the integration of AI, which is creating new opportunities and challenges for the industry. Most insurance brokers see AI as an opportunity to increase their efficiency and provide a better service to their clients, even if there are concerns that their role could become redundant. Younger brokers in particular are more open to the tools. They are already using various AI tools, particularly for administrative tasks and to support customer service. However, the majority of brokers are critical of the benefits of these tools in advising customers.

Would you like to find out more about exciting topics from the world of adesso? Then take a look at our previous blog posts.